20 May 5 Qualities Your Early-Stage Startup Needs to Attract Investors

You’ve got a vision, a team behind it, and a product to sell.

Here’s the problem – you’re struggling to expand market reach on your limited budget and in need of a serious cash infusion to keep your business growing.

You won’t convince investors to fund your venture by sending frequent emails or cold-calling them – in fact, your efforts may actually have the opposite effect. Your best bet for attracting investor interest is by creating a business that they want to invest in, not one you have to convince them to consider.

While attracting investor interest is much easier said than done, there are a few key qualities investors look for before considering investing in a startup.

The Ability to Monetize

Let’s begin with the obvious question – is there an actual market need for the product or service you’re offering?

A CB Insights analysis of 101 failed startups revealed that tackling problems that are interesting to solve rather than those that serve a market need is the primary reason for startup failure. Without a market need for your product, your startup is dead in the water before it’s begun swimming.

A CB Insights analysis of 101 failed startups revealed that tackling problems that are interesting to solve rather than those that serve a market need is the primary reason for startup failure. Without a market need for your product, your startup is dead in the water before it’s begun swimming.

If you’re certain that there’s a market for your product, make sure that you’re able to cite a few ways your business will outperform your competitors. Struggling to accomplish this task implies that you may need to rethink your business model – begin by figuring out what makes your venture unique.

Investors want to hear how your business will captivate customers and the market, and that’s not going to happen if you’re selling them the same story as every other entrepreneur.

What is inventive about your business model? What do you offer that the world hasn’t seen before? How will your product make customers lives better? And most importantly, how will you convince them to buy?

A Track Record of Success

Most banks won’t give people a loan without looking over their credit history, and the same goes for investors when it comes to infusing their money into startup businesses. A track record of previous success is critical to attracting the interest of investors who can take your venture to the next level.

Because successful startups are a rarity, inexperienced entrepreneurs will run into far greater difficulty convincing investors to lend their capital. The solution? Most entrepreneurs building their first startup business rely heavily on themselves, their friends, and their family for funding.

However, if your model and product seems promising, you may catch the interest of an angel investor, someone who’s willing to give you capital in exchange for equity in your early-stage startup. These investors are more comfortable taking high-stake risks than venture capitalists, who prefer to monitor the growth of a company until they’re sure it’s got a decent chance of success.

Click here to learn more about angel investing and how you can attract angel investors to your business.

A Scalable Business Model

We’ve talked about scaling startups in a past blog, so we’ll just briefly touch on it here.

A quick refresher: scaling is adding revenue at at a rapid rate while adding resources incrementally. The amount of of resources required doesn’t change as your customer base increases, driving consistent growth and improving profit margins.

To contrast, growing is adding revenue at the same pace you’re adding resources – if you triple your volume, you require triple the resources, and your profit margins stay the same.

With that said, was your business model created with scaling in mind?

Investors expect a significant return on their investment, and the faster they receive it, the better. While building a business capable of scaling primarily depends on the industry (it’s simpler to scale a software company than a personal training agency), you’re going to attract more interest if scaling is a real possibility in your startup’s future.

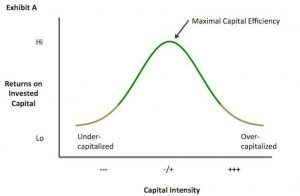

Capital Efficiency

Capital efficiency is defined as “the measure of a company’s ability to select, deploy, and manage capital investments that maximize shareholder value.” Investors want to know that you’re spending their money wisely, in order to best support the growth of your venture.

They don’t want to give you so little that you’ll struggle to grow, but they also don’t want to give you so much money that you end up blowing it unnecessarily.

One way entrepreneurs can demonstrate their commitment to capital efficiency is by creating detailed plans of how they’ll use an investor’s funding.

For example: you’re hoping to receive one million dollars in funding in an upcoming investment round. Begin by defining how much you plan to spend people and payroll first, as it’ll likely be your #1 cost. From there, determine how much office space you’ll need, equipment and technology costs, marketing costs, etc.

Using analytic and metric data to support the reasoning behind your financial decisions isn’t a bad idea either.

The Ability to Execute

Arguably the most important quality in a startup is the team’s ability to execute their plan – to make what they want to happen, happen.

While there are many internal and external factors that can interfere with a team’s ability to accomplish their goals and objectives, a few are particularly detrimental to a startup’s viability.

- Internal threats: disharmony among co-founders, a lack of necessary funds, an underdeveloped business model, mistiming the release of a product or service

- External threats: new competitors or copycats, lobbyists or laws preventing the use/sale of a product, negative market trends

To limit the impact of threats, emphasize the practice of environmental scanning to your team. In other words, you should consistently be gathering information about internal and external events and how they could affect your business.

As is the case with life in general, there will always be factors out of your control. However, if you strive to improve and strengthen your performance in the qualities listed above, you’ll have a much better chance of attracting investors who’ll consider funding your startup business.

From an investor’s perspective, which quality would you consider to be the most important when it comes to deciding to invest in a startup? Leave a comment on our LinkedIn or Facebookpages and let us know what you think!

——————————————————————————————————————————————————————————————————–

If you’re in search of talent consulting or recruiting services and could use help determining your business needs, contact our team of experienced talent acquisition consultants now.